- 2024-11-01T00:00:00

- Company Research

- VIC’s 9M 2024 PBT was VND11.3tn (USD452mn; -9% YoY), mainly driven by (1) full stake sales in SDI Trading Development and Investment Company Limited (SDI) in 9M 2024 with a pre-tax gain of VND21.3tn (USD852mn; of which VND15.5tn/USD620mn was in H1 2024), and (2) VHM’s property sales, including bulk sales at Royal Island recognized in Q2 2024. VIC’s NPAT-MI was VND9.7tn (USD388mn; +4.4x YoY) in 9M 2024.

- We foresee downside risk to our 2024F PBT and NPAT-MI forecasts, pending a fuller review, mainly due to 9M 2024 higher-than-expected EBIT loss for the industrial segment and financial expenses, partly offset by the better 9M 2024 EBIT of the leasing and hospitality segments.

- Property segment: See more details in our October 30 VHM Earnings Flash.

- Hospitality segment: The segment’s 9M 2024 EBIT loss improved to VND822bn (USD33mn) vs an EBIT loss of VND3.7tn (USD148mn) in 9M 2023, driven by sustained improvement in visitor traffic and the Q1 2024 transfer of the company’s portfolio of beach villas and condotels to local partners.

- Industrial segment: VFS delivered 21,900 EV units in Q3 2024 (+66% QoQ and +116% YoY), and 44,260 units in 9M 2024 (+108% YoY), primarily from the Vietnam market. The 9M 2024 delivery results complete 78% of our 2024F forecast of 57,000 units (+71% YoY), and 55% of the company’s full-year guidance.

- Transaction of SDI stake sales: As of end-Q3 2024, VIC has completed full divestment of its 100% stake in SDI (comprised of a first tranche of a 55% stake in Q1, a second tranche of a 15% stake in Q2, and a final tranche of a 30% stake in Q3) and received full cash proceeds of VND39.08tn (USD1.6bn) – consistent with management’s previous statement in April 2024 (see details of the divestment plan here).

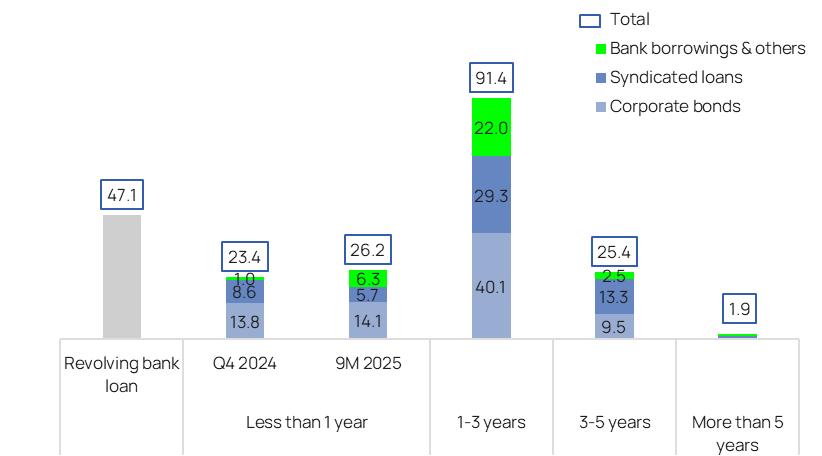

- Debt balance: As of end-Q3 2024, VIC’s total debt was VND215tn (USD8.6bn; +1% YTD and -3% QoQ), with USD-denominated debts accounting for 24.5% of the total debt. Debts maturing within 12 months include (1) revolving bank loans of VND47.1tn (USD1.9bn), (2) long-term debts amounting to VND23.4tn (USD937mn) due in Q4 2024 (with 100% secured refinancing plans), and VND26.2tn (USD1.05bn) in 9M 2025 (refinancing plans are being prepared).

Figure 1: VIC’s 9M 2024 results

VND bn | 9M 2023 | 9M 2024 | YoY% Growth | 2024F | 9M as % of 2024F | Vietcap’s comments on 9M 2024 results |

Net revenue | 134,207 | 126,916 | -5% | 167,521 | 76% |

|

| 89,511 | 65,260 | -27% | 91,718 | 71% | * Key handovers: Ocean Park 2 and 3 and the start of retail handovers at Royal Island from Q3 2024. |

| 6,730 | 2,810 | -58% | 3,714 | 76% | * VRE was not consolidated into VIC’s financial statements at end-Q1 2024. |

| 6,602 | 6,482 | -2% | 7,587 | 85% | * If excluding the performance of beach villas and condotels in 9M 2023, the segment revenue would have increased 75% YoY in 9M 2024, per management. |

| 17,156 | 28,142 | 64% | 38,713 | 73% | * VinFast delivered 44,260 EV units (+108% YoY) – completing 78% of our 2024F forecast. |

| 14,208 | 24,222 | 70% | 25,789 | 94% | * Mainly from construction services for property bulk sales partners. |

|

|

|

|

|

| |

EBIT | 7,855 | -4,291 | N.M. | -1,549 | N.M. |

|

| 31,290 | 20,717 | -34% | 27,331 | 76% |

|

| 3,599 | 1,660 | -54% | 1,331 | 125% |

|

| -3,696 | -822 | N.M. | -1,286 | 64% | * YoY improvement in 9M 2024 EBIT loss was driven by sustained improvement in visitor traffic and the transfer of portfolio of beach villas and condotels to local partners in Q1 2024. |

| -22,847 | -28,014 | N.M. | -28,976 | 97% | * 9M 2024 EBIT loss margin was higher-than-expected. |

| -491 | 2,167 | N.M. | 51 | N.M. |

|

|

|

|

|

|

|

|

Financial income | 15,567 | 37,813 | 143% | 36,446 | 104% | * Includes i) a pre-tax gain of VND21.3tn (USD852mn) from full divestment of the 100% stake in SDI in 9M 2024, ii) a Q2 2024 pre-tax gain of VND8tn (USD320mn) from bulk sales at the Royal Island project, and iii) VND2.9tn (USD116mn) recognized from transferring the portfolio of beach villas and condotels. |

Financial expenses | -16,477 | -23,493 | 43% | -26,361 | 89% |

|

Profit from associates | 0 | 686 | N.M. | 898 | 76% |

|

Other gain (loss) | 0 | 577 | N.M. | 3,300 | 17% | * Includes Chairman’s grants to VinFast amounting to VND3.3tn (USD129mn) in Q2 2024. |

PBT | 12,375 | 11,292 | -9% | 12,734 | 89% |

|

Tax expenses | -10,819 | -7,223 | -33% | -10,834 | 67% |

|

PAT | 1,556 | 4,069 | 161% | 1,900 | 214% |

|

Minority interest | -665 | -5,642 | 748% | -699 | 807% |

|

NPAT-MI | 2,221 | 9,711 | 337% | 2,599 | 374% | * 9M 2024 NPAT-MI was mainly supported by the completed 100% stake sales in SDI and VHM’s property sales in 9M 2024. |

|

|

|

|

|

|

|

EBIT margin | 5.9% | -3.4% |

| -0.9% |

|

|

| 35% | 32% |

| 30% |

|

|

| 53% | 59% |

| 36% |

|

|

| -56% | -13% |

| -17% |

|

|

| -133% | -100% |

| -75% |

|

|

|

|

|

|

|

|

|

PBT margin | 9.2% | 8.9% |

| 7.6% |

|

|

PAT margin | 1.2% | 3.2% |

| 1.1% |

|

|

Effective tax rate | 87.4% | 64.0% |

| 85.1% |

|

|

NPAT-MI margin | 1.7% | 7.7% |

| 1.6% |

|

|

Source: VIC’s consolidated financial statements, Vietcap forecast (updated August 22, 2024)

Figure 2: VFS’s delivery results

Units | Q1 2022 | Q2 2022 | Q3 2022 | Q4 2022 | Q1 2023 | Q2 2023 | Q3 2023 | Q4 2023 | Q1 2024 | Q2 2024 | Q3 2024 | 2023 | 9M 2024 | |

E-scooters | 15,100 | 15,300 | 13,200 | 16,400 | 9,000 | 10,200 | 27,500 | 23,600 | 7,800 | 13,100 | N/A | 70,300 | N/A | |

Cars | EV | 500 | 1,800 | 200 | 4,900 | 1,400 | 9,200 | 10,100 | 13,100 | 9,200 | 13,200 | 21,900 | 33,300 | 44,300 |

ICE | 6,200 | 6,400 | 3,800 | 330 | VFS fully transformed into a pure EV producer in July 2022. | |||||||||

% sold to related parties (mainly GSM) | ||||||||||||||

E-scooters | data is not available | 36% | 33% | N/A | 44% | N/A | ||||||||

Cars | EV | data is not available | 57% | 51% | N/A | 72% | N/A | |||||||

Source: Vinfast, Vietcap compilation and estimates (numbers rounded to the nearest hundred)

Figure 3: VIC’s total debt breakdown by maturity (VND tn) as of end-Q3 2024

Source: VIC, Vietcap compilation

Figure 4: VIC’s current outstanding international exchangeable bonds (EBs) at end-Q3 2024

EB name | Principal amount (USDmn) | Outstanding amount (USDmn) as of end-Q3 2024 | Issue date | Maturity date | Put option exercise date for bondholders | Interest rate | Exchangeable shares (secondary shares owned by VIC/affiliates) |

Vingroup USD500mn 3% EBs due 2026 (listed) | 500 | 0(1) | 2021 | 2026 | April 2024 | 3% | VHM shares |

Vingroup USD250mn 10% EBs due 2028 (listed) | 250 | 250(2) | 2023 | 2028 | November 2026 | 10% | VHM shares |

Vingroup/ | 625 | 234.5(3) | 2022 | 2027 | April 2024; extended by 18 months | 5% | VinFast shares |

Vinpearl USD425mn 3.25% EBs due 2026 (listed) | 425 | 0 (4) | 2021 | 2026 | September 2024 | 3.25% | VIC shares |

Vinpearl USD150mn 9.5% EBs due 2029 (listed) | 150 | 150 (5) | 2024 | 2029 | August 2027 | 9.5% | VIC shares |

Source: Vietcap compilation. Note: (1) As of end-April 2024, VIC used cash on hand to redeem 50% of the USD500mn principal; (2) The proceeds were used to buy back 50% of the USD500mn principal of the Vingroup USD500mn 3% EBs due in 2026; (3) VIC repurchased USD312.5mn in April 2024 and USD78mn in Q3 2024, and reached an agreement with bondholders to extend the early redemption of the remainder by 18 months; (4) Vinpearl repurchased all of the USD425mn principal in Q3 2024; (5) In August 2024, Vinpearl issued the new USD150mn EBs, in which the proceeds from new EBs, along with the new international syndicated loan, were used for the repurchase of a large portion of the Vinpearl USD425mn 3.25% EBs due in 2026.

Powered by Froala Editor