- 2024-04-26T00:00:00

- Company Research

- VHM announced Q1 2024 NPAT-MI of VND885bn (USD35mn; -93% YoY), mainly supported by handovers at Ocean Park 1, 2 & 3. The YoY decline in Q1 2024 was mainly due to 1) YoY lower property handovers and 2) no bulk sales being recorded in Q1 2024 whereas in Q1 2023, VHM recognized bulk sales transactions at Ocean Park 2&3 with a total pre-tax gain of VND8.5tn (USD340mn). Although the Q1 2024 NPAT-MI completes only 3% of our 2024F forecast, we foresee insignificant change to our 2024F NPAT-MI of VND29.3tn (USD1.2bn; -12% YoY).

- New project Vinhomes Royal Island has received positive absorption. On March 15, VHM held an introduction event for the new project Vinhomes Royal Island (formerly known as Vu Yen project, Hai Phong Province, total size of 877 ha). Per management, this project has received 1,800 non-refundable bookings as of end-Q1 2024, equivalent to 82% of this first retail presales launch (2,200 units). This performance reaffirms our projection for this project to contribute 21% into our 2024F contracted sales value forecast for VHM. Management stated that this project will start handovers from Q2 2024.

- The contracted sales value was VND16.2tn in Q1 2024 (USD648mn; -47% QoQ and +3% YoY), entirely from retail presales. Key contributors to Q1 2024 contracted sales value were Vinhomes Royal Island project, which accounted for 86%, as well as other launched projects (mainly Golden Avenue and Ocean Park 2) that accounted for the remainder.

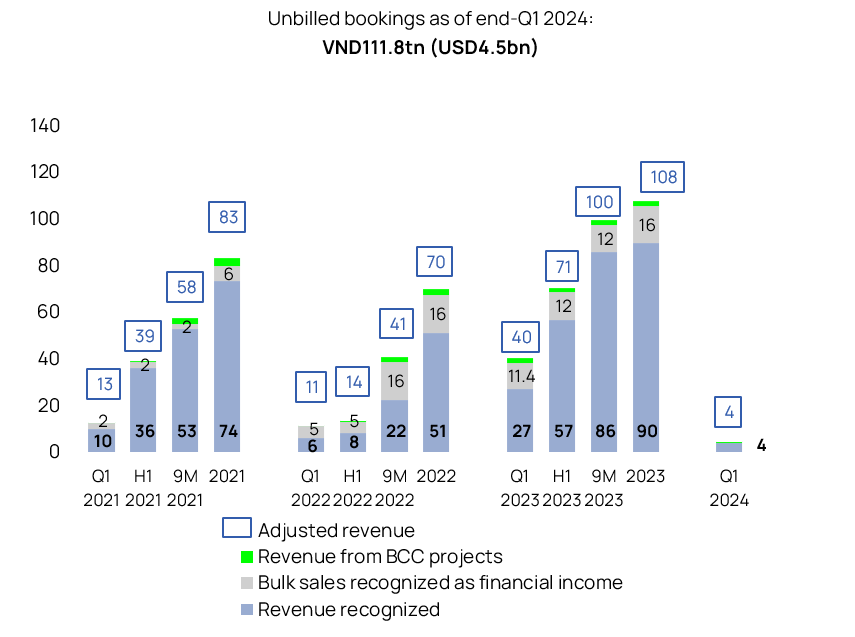

- Unbilled bookings as of end-Q1 2024 amounted to VND111.8tn (USD4.5bn; +21% YoY) with bulk sales accounting for 59%. Management expects approximately 70% of the end-Q1 2024 unbilled bookings will be recognized in subsequent quarters of 2024G.

- Management guides for 2024G contracted sales value to grow YoY to VND90tn-110tn (USD3.6bn-4.4bn) vs VHM’s 2023 result of VND87tn (USD3.5bn; -32% YoY) and our 2024F forecast of VND75tn (USD3.0bn; -14% vs a high base of bulk sales in 2023). Key projects to support the 2024G contracted sales value guidance include launched projects (such as Ocean Park 2 & 3, and Golden Avenue), new project Vinhomes Royal Island, and 1-2 upcoming new projects.

Figure 1: VHM’s Q1 2024 results

VND bn | Q1 2023 | Q1 2024 | YoY | 2024F | Q1 2024 as % of 2024F |

Net revenue | 29,299 | 8,211 | -72% | 120,895 | 7% |

| 27,004 | 4,085 | -85% | 109,953 | 4% |

| 2,295 | 4,126 | 80% | 10,942 | 38% |

|

|

|

|

| |

Gross profit | 6,643 | 1,774 | -73% | 44,234 | 4% |

SG&A expenses | -1,558 | -912 | -41% | -6,894 | 13% |

EBIT | 5,085 | 862 | -83% | 37,340 | 2% |

Financial income | 11,294 | 1,956 | -83% | 3,759 | 52% |

| 834 | 195 | -77% | 462 | 42% |

| 10,460 | 1,761 | -83% | 3,297 | 53% |

Financial expense | -877 | -1,369 | 56% | -4,353 | 31% |

Other gain/loss | -428 | -34 | N.M. | 0 | N.M. |

PBT | 15,074 | 1,416 | -91% | 36,746 | 4% |

PAT | 11,923 | 904 | -92% | 29,396 | 3% |

NPAT-MI | 11,917 | 885 | -93% | 29,309 | 3% |

|

|

|

|

| |

Gross margin % | 22.7% | 21.6% |

| 36.6% |

|

SG&A as % sales | 5.3% | 11.1% |

| 5.7% |

|

EBIT margin % | 17.4% | 10.5% |

| 30.9% |

|

Effective tax rate % | 20.9% | 36.1% |

| 20.0% |

|

NPAT-MI margin % | 40.7% | 10.8% |

| 24.2% |

|

Source: VHM, Vietcap forecast (last updated February 21, 2024). Note: (*) Vingroup signed a business cooperation contract (BCC) with VHM to fully transfer the economic interest of real estate developments that are not injected into VHM due to the complexity of paperwork. Thus, VHM records all gains via financial income.

Figure 2: Property segment’s revenue (VND tn)

Source: VHM, Vietcap compilation. Note: Adjusted revenue includes (1) revenue recognized as property revenue, (2) revenue from BCCs, and (3) bulk sales recognized as financial income.

Powered by Froala Editor