- 2024-10-31T00:00:00

- Company Research

- PLX released its Q3 2024 results with revenue of VND64tn (-11% YoY) and reported NPAT-MI of VND65bn (-91% YoY). The YoY decline in reported NPAT-MI was mainly due to (1) a 1.3% decrease in sales volume from Typhoon Yagi's impact, (2) negative EBIT margin from a 6% QoQ drop in oil prices leading to high input costs and continued high-priced petroleum imports, and (3) a 5% increase in SG&A expenses, driven by a 6% YoY rise in outsourcing and cash costs due to repairs from the typhoon's effects on several stations. Additionally, (4) financial income fell by 58% YoY because there was no one-off divestment gain, vs the PG Bank divestment gain in Q3 2023. We note that there was an insignificant inventory provision expense in the quarter.

- For 9M 2024, revenue was VND213tn (+4% YoY) and reported NPAT-MI of VND2.3tn (+8% YoY). Excluding one-off income from the PG Bank divestment, recurring NPAT-MI was VND2.3tn (+43% YoY). This growth was driven by (1) a slight increase in sales volume (0.5% YoY) and (2) a GPM expansion of 0.5 ppts, partly supported by higher regulated operating costs.

- 9M 2024 revenue and NPAT-MI complete 74% and 56% of our full-year forecasts, respectively, lower than our expectation. We foresee downside risk to our 2024 earnings forecast, pending a fuller review, due to (1) lower-than-expected GPM for 2024, and (2) higher-than-expected SG&A expenses, coupled with (3) lower-than-expected income from JVs.

- Although Q3 results fell short of our expectations, we maintain our expectation of the benefits from rising regulated operating costs and the positive impact of new petroleum regulations to allow petrol distributors to set their own prices, which could help PLX enhance its gross profit margin in future years. 9M 2024 GPM was higher YoY, which we attribute to the positive impact from higher YoY regulated operating costs. In July 2024, regulated costs for gasoline and diesel per liter rose by VND60 and VND140, reflecting increases of 6% and 14%, respectively. These adjustments are expected to better cover actual operating costs for petroleum distributors moving forward.

Figure 1: PLX’s 9M 2024 results

VND bn | Q3 2023 | Q3 2024 | YoY | 9M 2023 | 9M 2024 | YoY | % of Vietcap’s 2024F |

Brent oil price (USD/bbl) * | 86 | 79 | -8% | 82 | 82 | 0% | 99% |

Gasoline price (VND/liter) * | 22,511 | 20,848 | -7% | 21,994 | 21,942 | 0% | 113% |

Diesel price (VND/liter) * | 21,196 | 19,160 | -10% | 20,304 | 20,012 | -1% | 104% |

Domestic sales volume (mn m3) | 2.57 | 2.54 | -1.3% | 7.77 | 7.81 | 0.5% | 72% |

Revenue | 72,414 | 64,324 | -11% | 205,596 | 212,990 | 4% | 74% |

Gross profit | 3,780 | 3,437 | -9% | 11,270 | 12,712 | 13% | 68% |

Selling expense | -3,110 | -3,318 | 7% | -8,876 | -9,637 | 9% | 76% |

G&A expense | -216 | -268 | 24% | -642 | -755 | 18% | 74% |

Operating profit | 454 | -149 | -133% | 1,752 | 2,319 | 32% | 47% |

Financial income | 1,189 | 495 | -58% | 2,135 | 1,341 | -37% | 72% |

Financial expenses | -627 | -231 | -63% | -1,365 | -942 | -31% | 65% |

Interest expenses | -226 | -174 | -23% | -689 | -508 | -26% | 48% |

Profit/(loss) from JVs, associates | 137 | 109 | -20% | 480 | 385 | -20% | 61% |

PBT | 1,180 | 241 | -80% | 3,082 | 3,200 | 4% | 56% |

Income tax | -450 | -111 | -75% | -794 | -649 | -18% | 56% |

Reported NPAT-MI | 738 | 65 | -91% | 2,171 | 2,345 | 8% | 56% |

Core NPAT-MI | 192 | 51 | -94% | 1,583 | 2,268 | 43% | 52% |

|

|

| Δ ppts |

|

| Δ ppts |

|

Gross profit margin % | 5.2% | 5.3% | +0.1 | 5.5% | 6.0% | +0.5 |

|

Sales & marketing % sales | 4.3% | 5.2% | +0.9 | 4.3% | 4.5% | +0.2 |

|

General admin % sales | 0.3% | 0.4% | +0.1 | 0.3% | 0.4% | +0.0 |

|

EBIT Margin | 0.6% | -0.2% | -0.9 | 0.9% | 1.1% | +0.2 |

|

NPAT-MI margin | 1.0% | 0.1% | -0.9 | 1.1% | 1.1% | +0.0 |

|

Core NPAT-MI margin | 0.3% | 0.1% | -0.2 | 0.8% | 1.1% | +0.3 |

|

Source: PLX, Vietcap (*average prices)

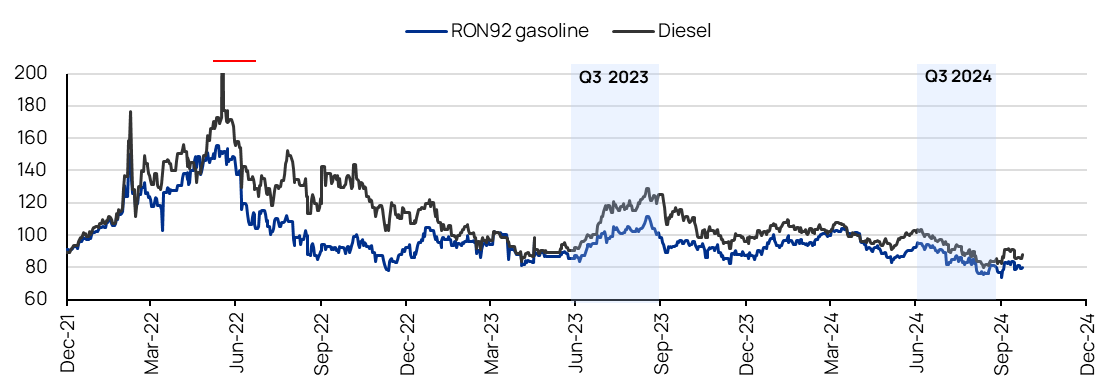

Figure 2: Platts Singapore price movement (reference point for Vietnamese petroleum retail prices), excluding the impact of the petroleum stabilization fund (USD/bbl)

Source: Ministry of Industry and Trade, Vietcap (data as of October 23, 2024)

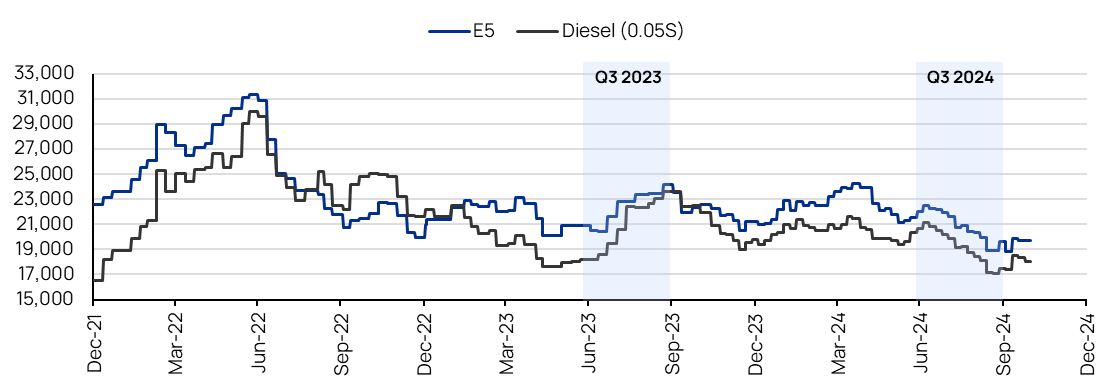

Figure 3: Vietnamese E5 gasoline and diesel retail prices, including the impact of the petroleum stabilization fund (VND/liter)

|

Source: PLX, Vietcap (data as of October 23, 2024)

Powered by Froala Editor